All Categories

Featured

Consider Using the penny formula: dollar represents Financial debt, Revenue, Home Mortgage, and Education and learning. Total your financial obligations, home mortgage, and university expenses, plus your salary for the variety of years your family needs protection (e.g., till the kids are out of your house), which's your coverage need. Some economic specialists compute the quantity you need making use of the Human Life Value viewpoint, which is your life time earnings possible what you're gaining currently, and what you anticipate to make in the future.

One way to do that is to look for companies with solid Economic strength rankings. decreasing term life insurance cash value. 8A company that underwrites its own policies: Some firms can offer plans from another insurance provider, and this can include an added layer if you wish to alter your policy or down the road when your family requires a payout

What Is Extended Term Life Insurance

Some business supply this on a year-to-year basis and while you can anticipate your prices to increase significantly, it might deserve it for your survivors. One more method to contrast insurance provider is by taking a look at on the internet client evaluations. While these aren't most likely to inform you a lot regarding a firm's monetary stability, it can tell you exactly how easy they are to function with, and whether cases servicing is a trouble.

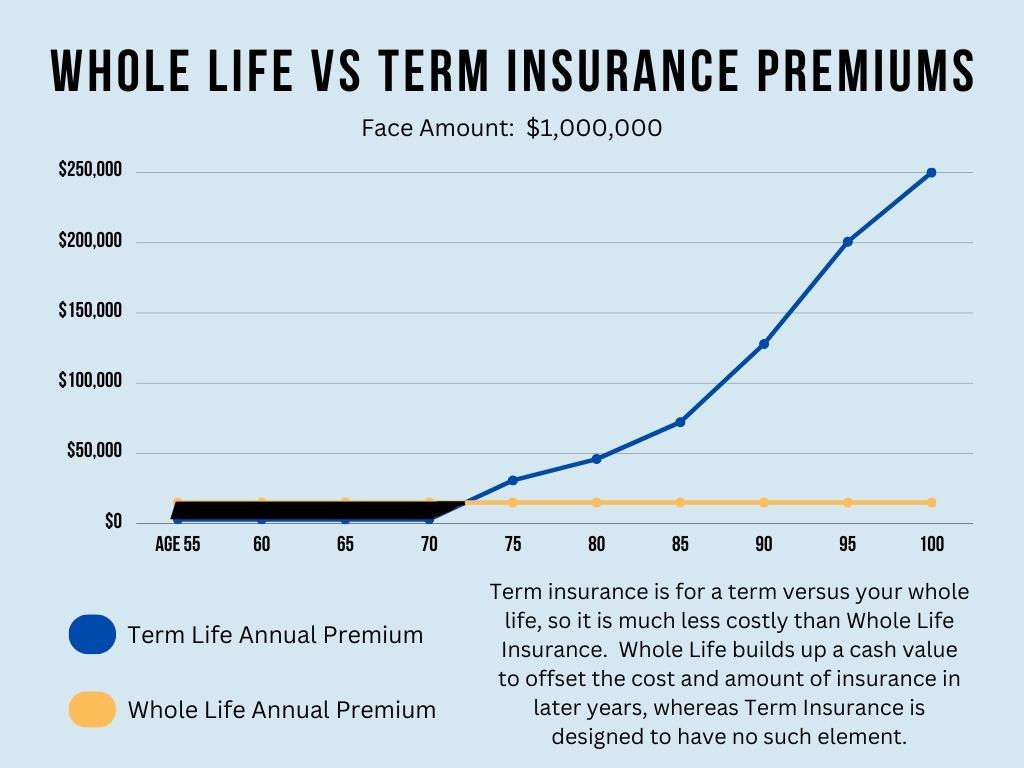

When you're younger, term life insurance policy can be a simple means to protect your enjoyed ones. As life modifications your economic top priorities can too, so you might want to have entire life insurance coverage for its lifetime insurance coverage and additional benefits that you can utilize while you're living.

Approval is guaranteed no matter your wellness. The costs will not raise as soon as they're established, however they will certainly increase with age, so it's a great idea to secure them in early. Learn even more regarding just how a term conversion functions.

1Term life insurance provides temporary protection for a vital period of time and is normally more economical than irreversible life insurance policy. life insurance level term or decreasing. 2Term conversion guidelines and restrictions, such as timing, might use; for instance, there may be a ten-year conversion opportunity for some items and a five-year conversion privilege for others

3Rider Insured's Paid-Up Insurance Purchase Option in New York. There is a cost to exercise this cyclist. Not all getting involved plan proprietors are eligible for returns.

Latest Posts

Short-term Life Insurance

The Cost Of 500 000 Worth Of 30-year Term Life Insurance For Fernando

Which Type Of Policy Can Group Term Life Insurance Normally Be Converted To